- QUICKBOOKS DESKTOP 2019 SUPPORT HOW TO

- QUICKBOOKS DESKTOP 2019 SUPPORT INSTALL

- QUICKBOOKS DESKTOP 2019 SUPPORT UPDATE

- QUICKBOOKS DESKTOP 2019 SUPPORT PRO

QUICKBOOKS DESKTOP 2019 SUPPORT UPDATE

This update includes updates to User Management and 1099 Tax Forms. If you don't want this update automatically downloaded, NOW is the time to turn-off Auto Updates. You can manually download the update from the Official Intuit QuickBooks Downloads and Updates Webpage (product/version specific).

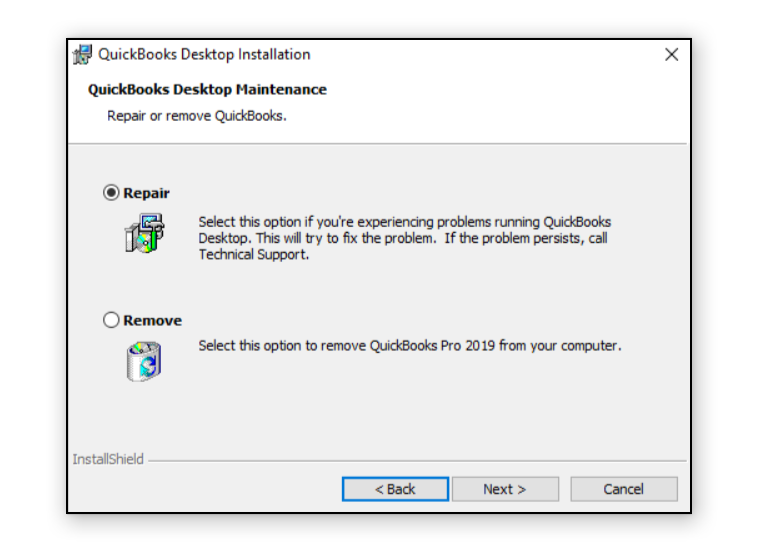

QUICKBOOKS DESKTOP 2019 SUPPORT INSTALL

If you have automatic updates turned on, QuickBooks will download the updates for you and prompt you to install it.

QUICKBOOKS DESKTOP 2019 SUPPORT PRO

The changes, improvements and fixes elaborated below were included in this release for QuickBooks Pro 2019, QuickBooks Premier 2019, QuickBooks Accountant 2019 and QuickBooks Enterprise v19.0.īe aware that each new update also includes all the changes from earlier updates. Learners must be enrolled in an educational institution to obtain QuickBooks trial software and to use eLab.

This book is for courses using Intuits Desktop QuickBooks, not the cloud-based Online software version.

So they have begun to roll-out the Maintenance Release 14 (R14) Update to the 2019 QuickBooks Desktop product line. QuickBooks Desktop 2019 trial software cannot be requested after May 31, 2022.

QUICKBOOKS DESKTOP 2019 SUPPORT HOW TO

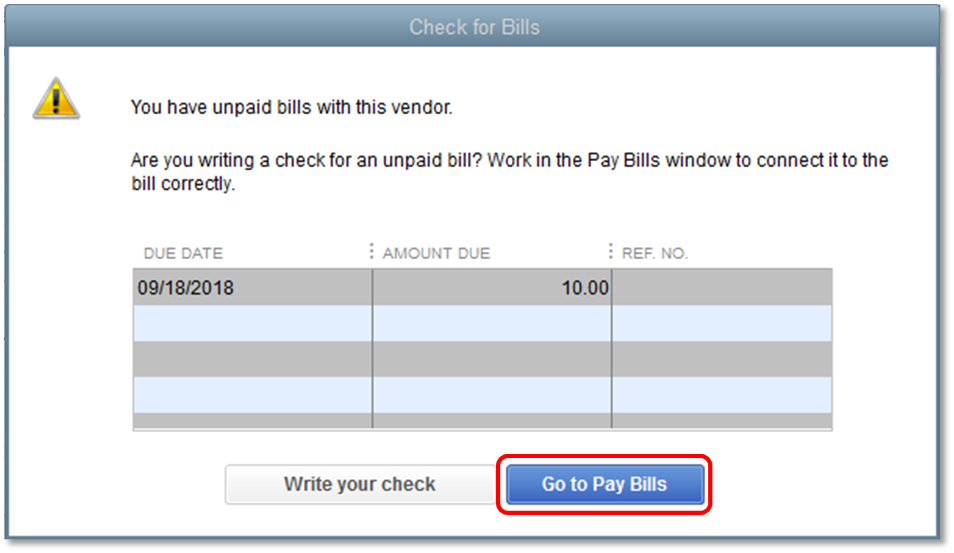

Take a look at this video on how to pay bills online with QuickBooks Desktop.As with QuickBooks 2020 and QuickBooks 2021 within the last 7 days, Intuit has now rolled-out a December release to meet certain tax-form requirements prior to year-end. Once the payment is processed, QuickBooks marks the bill as paid, for visual confirmation. Once you move into the Accounting section. Here at this point, select the Account and Settings option. Post that, navigate to the Gear Icon located on the top. Vendor payment details are securely recorded with Melio and not in the QuickBooks Desktop Company file. Here we will learn about how to set fiscal year in QuickBooks 2018: Open QuickBooks Online on the system. Separately, they can choose how their vendor will receive the payment - as a deposit in their bank account (ACH) or as a paper check. QuickBooks users can choose to pay their vendor bills by ACH, debit or credit card. Assign a specific day for the payment to be processed and sent. QB Pro Desktop 2018 seems to be a step down from QB Pro 2014. I know one can get to it by Edit Transaction, just one more step that slows entry down. Optionally, on demand, users can select Sync Online Bill Payments from the menu bar to sync these details with the QuickBooks Company file.įeatures: Users can schedule vendor payments online from within QuickBooks. I looked for Class among the Available Columns to add. As the charges are deducted from your funding source, QuickBooks will record the fee bill as paid. supported by Microsoft Windows Server 2012 (or R2), 2016 or 2019. Note: If paying a vendor bill with a payment type that includes a separate processing fee, QuickBooks will create a vendor named Melio, and these charges will be added as a vendor bill. : QuickBooks Desktop Pro Plus with Enhanced Payroll 2022 Accounting Software. Optionally, from a displayed vendor bill, select Schedule Online Payment from the top right of the main ribbon. How to find it: From the menu bar, select Vendors > Pay Bills. Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0.

0 kommentar(er)

0 kommentar(er)